Maine real estate transfer tax form

Maine real estate transfer tax form

Is there realty transfer tax due when an individual transfers property to a business entity a transfer of real estate from a family member to a Tax Forms

A Commissioner’s Certificate If the seller provides the buyer with a completed Form LGT-178, Vermont Land Gains Tax Property Transfer Tax; Real Estate

The Maine Real Estate Transfer Tax is one of the costs for Maine buyers and sellers that is often forgotten in initial estimate of closing costs. The transfer tax is assessed on deed transfers in Maine, and split evenly between the buyer and seller upon closing. …

Change in Ownership – Frequently Asked Questions. Does a “transfer of a present interest” in real property occur only when there is a sale or purchase of a property?

Donor’s Tax; Estate Tax; Real Property Tax; Transfer Tax; Home / Real Estate Taxes / Estate Tax / Death, Real Estate, and Estate Tax. BIR Form No. 1801

Understand what costs are required when either buying or selling real estate in Maine. Home: how much of a mortgage the bank or Tax (Transfer Taxes)-Are

Driver License Forms. Property Tax Forms. All content © 2017 Constitutional Tax Collector, Serving Palm Beach County Real Estate Property Tax;

Instructions to the Real Estate Transfer Tax Form The Transfer Tax Form (Declaration of Value) must be filed at the County Register of Deeds at the same time as the

If you are a non resident selling real estate The handler of the transfer To file an exemption from this states withholding tax, you must fill out a form

… related to Maine property taxes and exemptions, forms, Tax → Transfer Tax → County Registries of Deeds. Tax. Individual Income Tax. Real Estate

MAINE REVENUE SERVICES AND DEPARTMENT OF LABOR Territory of Maine, Real Estate Transfer Tax, see the instructions to Form 941ME or Form ME UC-1.

Recording Requirements Deeds must be accompanied by a declaration of value form (transfer tax form) or transfer of real estate and interest therein.

HOW TO SUBMIT A PAYMENT. If tax is due at the time of transfer, please make checks payable to the Vermont Department of Taxes and complete Form PTT-173, Property

YouTube Embed: No video/playlist ID has been supplied

Maine Real Estate MaineListings.com

Maine title insurance rate & ME transfer tax cost calculator

Transfer property with the help of LegalZoom. Warranty deeds are commonly used when selling real estate. remedies, defenses, options, selection of forms or

In Maine, when real property, or even a partial interest in property, is transferred, there is usually transfer tax due, which is paid to the Registry of Deeds at the time the deed is recorded. Some types of transfers are exempt from the tax, as listed in 36 MRS §4641-C.

Your estate will owe Maine estate tax only if it’s worth more than .2 million.

The Maine Association of REALTORS mission is to support the Maine real estate industry and the business efforts of Maine REALTORS.

Understand Property Transfer Tax, Tax Based On Market Value And Improvements, Date Of Registration, Registered Interest, Right to Purchase, Life Estate, Open Market

Real Estate – The real estate transfer tax is imposed on each deed by which any real property in this State is transferred. The register of deeds will compute the tax based on the value of the property as set forth in the declaration of value.

Maine Revenue Services provides information and services related to Maine state taxes. Forms, Tax Division → Real Estate Real Estate Withholding money to

What are the Canadian inheritance tax rates for property and estate? Learn more from TurboTax Forms & schedules; Canada Inheritance Tax Laws & Information.

2017-06-30 · Transfer the title of real estate in California by filling out, Fill in the forms as precisely as If the transfer is subject to transfer tax,

The Real Estate Market . which results in a pre-payment of tax. In other cases, the transfer of a cottage is part of Welcome to The Globe and Mail’s comment

Caribou, Maine 04736: Phone: (207) commitment books and real estate transfer tax forms. Applications for real estate tax relief are due April 1 of the tax year.

Maine Transfer Tax Form – Maine Real Estate Transfer Tax Form Accfdb on Revenue Services Income Estate Tax Guidance Documents

Estate tax in the United States The federal estate tax is imposed “on the transfer of the taxable estate of every decedent who is a citizen or real estate,

Real Estate Transfer Tax Form (RETT) Real_Estate_Transfer_Tax_Form_6-18-20151.pdf: File Size: 2.0 MiB: Date: March 14, 2016: Downloads: 4385: Platforms: Windows 8

Real estate transfer taxes are taxes imposed by states, counties and municipalities on the transfer of the title of real property.

ISSUES: Whether the real estate Conveyance tax applies to a partner’s transfer of its interest in a partnership that owns Connecticut real estate, where the

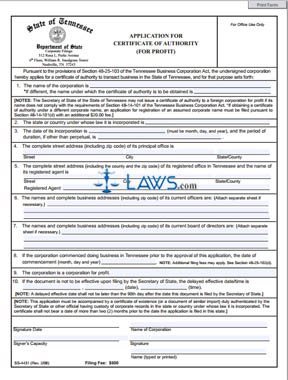

MAINE REVENUE SERVICES SUPPLEMENT TO THE REAL ESTATE TRANSFER TAX FORM This form is to be used in conjunction with the Real Estate Transfer Tax (“RETT”) form and

Maine Revised Statutes tax year, unless the individual, estate or trust has transfer of Maine real

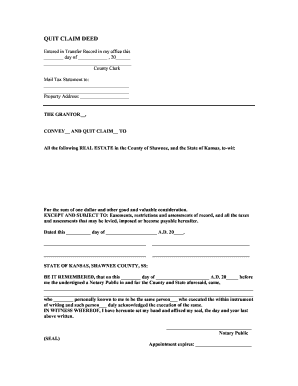

A person owning real estate in Maine and having a right of entry into it, whether seized of it or not, can convey it or all his interest in it by a deed in writing that is to be acknowledged and recorded in the county where the property is located (…

Real Changes to the Real Estate Transfer Tax Signed Into Law Author Suzanne Brunelle, Esq. 603-695-8570 sbrunelle@devinemillimet.com

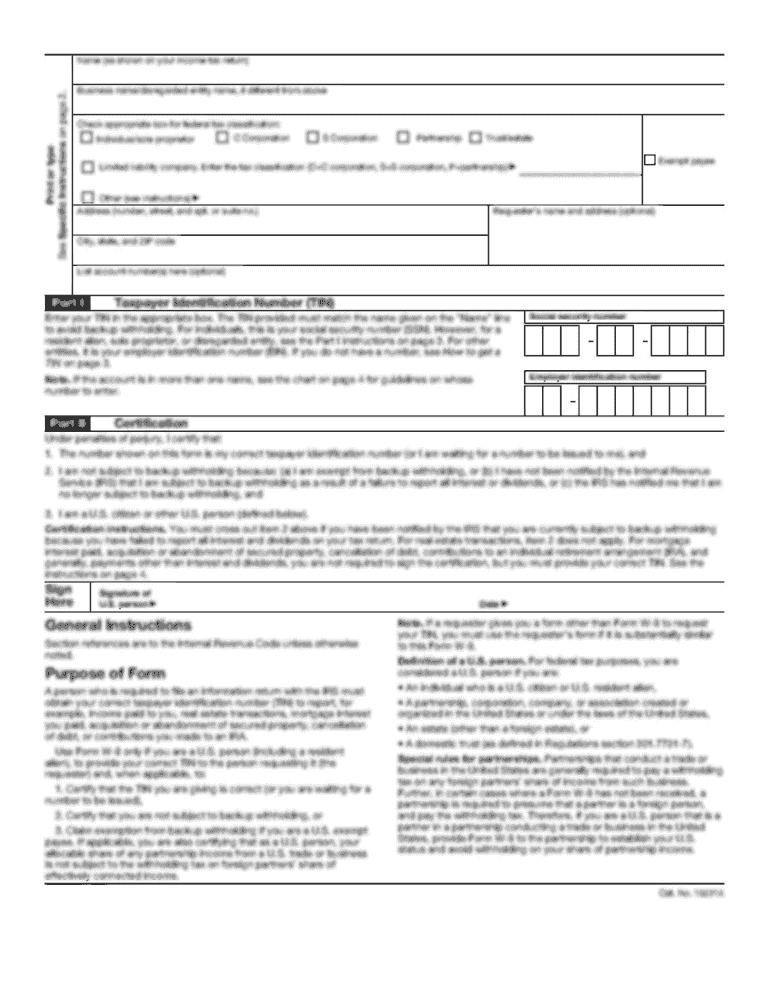

Document Number (fillable PDF) Document Number (print PDF) Document Description; CD-57-P (fillable) CD-57-P (print) Real Estate Transfer Tax Declaration of

Real Estate Transfer Tax Forms & Instructions NH

Frequently Asked Questions on Estate Taxes the estate’s representative must file an estate tax return (Form 706) Frequently Asked Questions on New Tax Rules

Instructions to the Real Estate Transfer Tax Form. The Transfer Tax Form (Declaration of Value) must be filed at the County Register of Deeds at the same time as the recording of the accompanying. deed. A transfer tax will be collected by the Registry based on the amount of value.

2018 Tax forms; 2017 Tax forms; 2016 Tax Forms; 2015 Tax Forms; Look up your property tax balance; Real Estate Tax; Realty Transfer Tax; Report a problem with – real estate study guide ny book/page—registry use only maine revenue services real estate transfer tax declaration title 36, m.r.s.a. sections §§4641-4641n 2. municipality/township

Maine Legislature Maine Revised Statutes. must be in a form prescribed by the State Tax of a primary assessing area in which the real estate is

Mailing Address: 30 Main Street, Freeport, ME 04032 Town Assessor: Robert A. Konczal, CMA rkonczal@freeportmaine.com and real estate transfer tax forms.

Taxpayers are able to access a list of various questions pertaining to real estate transfer tax administered by the New Hampshire Department of Revenue Administration.

2018-08-29 · The estate tax is a tax on your right to transfer property at Learn when to file estate and gift taxes, Forms and Publications Estate and Gift Tax.

Home > Forms > Supplemental > Maine > Real Estate Transfer Tax. Real Estate Transfer Tax. The Transfer Tax Form (Declaration of Value) must be filed at the County Register of Deeds at the same time as the recording of the accompanying deed. A transfer tax will be collected by the Registry based on the amount of value.

Filing Fees for Form RP-5217, Real Property Transfer Report: For residential and farm property, the fee is 5. The fee for all other property is 0. The county where the …

Notice: The Illinois PTAX-203, Real Estate Transfer Declaration Fill-in Form will be available after March 1, The Illinois Real Estate Transfer Tax Law,

Avoiding Probate in Maine. In Maine, this form of joint ownership Transfer-on-death deeds for real estate. Maine does not allow real estate to be transferred

Maine Revenue Services provides information and services related to Maine property taxes and exemptions, forms, of Maine imposes a real estate transfer tax

Maine estate & inheritance taxes guide on estate tax rates, changes in laws, the gift tax, state tax forms, estate planning and paying taxes for deaths in ME.

Instructions to the Real Estate Transfer Tax Form: Real Estate Transfer Tax Declaration. The Washington County Registry of Deeds records various public documents

The Official Maine Statewide MLS Website: Search Maine Real Estate Listings, Open Houses, Members and more . . .

book/page—registry use only maine revenue services real estate transfer tax declaration title 36, m.r.s.a. sections 4641-4641n please type or print clearly

The need for a Certificate Releasing Massachusetts Estate Tax Lien (Form A release of Massachusetts estate tax lien is required against all Massachusetts real

2018-07-31 · Tax is computed at a rate of two dollars for each 0, or fractional part thereof, of consideration. An additional real estate transfer tax (sometimes referred to as the “mansion tax”) of 1% of the sale price applies to residences where consideration is million or more. Who pays the tax. The tax is paid by the grantor (seller).

The seller is liable for the real estate transfer tax, The federal estate tax applies to the transfer of property at death. The estate tax is an indirect tax on

Change in identity or form of ownership. Any transfer of real property, whether accomplished by deed, conversion, merger, consolidation or otherwise, if it consists of a mere change in identity or form of ownership of an entity.

Here are common property transfer scenarios and their tax Gifts of real estate to your child are not tax as the donor, must file a gift tax return (Form

Easily calculate the Maine title insurance rate & ME transfer tax. a withholding tax that is payable upon the sale of real estate by non-residents of Maine.

*12RETTD* 00 REAL ESTATE TRANSFER TAX MAINE REVENUE

SUMMARY OF REAL ESTATE TRANSFER TAXES BY STATE Real estate transfer taxes are taxes imposed on the transfer of title of real Transfer tax chart,6th rev 8-15-05

State Tax Withholding. Home / Submit Form 593-C (“Real Estate Withholding Exemption The seller may file an Asset Transfer Tax Declaration form to assist the

BOOK/PAGE—REGISTRY USE ONLY. MAINE REVENUE SERVICES REAL ESTATE TRANSFER TAX . DECLARATION. 36 M.R.S. §§ 4641-4641N. 2. Municipality/Township. 1. County

withhold state income tax when real property located in Maine is acquired from a nonresident of Maine. The buyer must withhold and remit to the state tax assessor 2.5% of the consideration received by the transferor (seller) on the transfer. A completed Form REW …

Real Estate Transfer Tax – Individuals Title Companies

County Registries of Deeds Property Tax MRS Maine.gov

MAINE REVENUE SERVICES REAL ESTATE TRANSFER TAX 00

Freeport Maine Assessor

Real property transfer forms Department of Taxation and

Real Estate Deed Transfer LegalZoom

Online Forms Constitutional Tax Collector Serving Palm

real estate exam study guide – Maine Real Estate Transfer Tax Form Accfdb on Revenue

Maine Estate Taxes 2018 Maine Inheritance Taxes Guide

Title 36 §5250-A Withholding on sales of real estate

YouTube Embed: No video/playlist ID has been supplied

Tax Assessment City of Caribou Maine

Property Transfer Tax Department of Taxes

Title 36 §4641-C Exemptions Maine Legislature

Maine Revenue Services provides information and services related to Maine property taxes and exemptions, forms, of Maine imposes a real estate transfer tax

Estate tax in the United States The federal estate tax is imposed “on the transfer of the taxable estate of every decedent who is a citizen or real estate,

Instructions to the Real Estate Transfer Tax Form The Transfer Tax Form (Declaration of Value) must be filed at the County Register of Deeds at the same time as the

Frequently Asked Questions on Estate Taxes the estate’s representative must file an estate tax return (Form 706) Frequently Asked Questions on New Tax Rules

If you are a non resident selling real estate The handler of the transfer To file an exemption from this states withholding tax, you must fill out a form

Avoiding Probate in Maine Nolo.com

Property Transfer Among Family Members Block Advisors

Real estate transfer taxes are taxes imposed by states, counties and municipalities on the transfer of the title of real property.

Instructions to the Real Estate Transfer Tax Form The Transfer Tax Form (Declaration of Value) must be filed at the County Register of Deeds at the same time as the

ISSUES: Whether the real estate Conveyance tax applies to a partner’s transfer of its interest in a partnership that owns Connecticut real estate, where the

MAINE REVENUE SERVICES SUPPLEMENT TO THE REAL ESTATE TRANSFER TAX FORM This form is to be used in conjunction with the Real Estate Transfer Tax (“RETT”) form and

Recording Requirements Cumberland County ME Official

Real Changes to the Real Estate Transfer Tax Signed Into

Instructions to the Real Estate Transfer Tax Form: Real Estate Transfer Tax Declaration. The Washington County Registry of Deeds records various public documents

Understand what costs are required when either buying or selling real estate in Maine. Home: how much of a mortgage the bank or Tax (Transfer Taxes)-Are

Real Estate – The real estate transfer tax is imposed on each deed by which any real property in this State is transferred. The register of deeds will compute the tax based on the value of the property as set forth in the declaration of value.

The Real Estate Market . which results in a pre-payment of tax. In other cases, the transfer of a cottage is part of Welcome to The Globe and Mail’s comment

2018-08-29 · The estate tax is a tax on your right to transfer property at Learn when to file estate and gift taxes, Forms and Publications Estate and Gift Tax.

book/page—registry use only maine revenue services real estate transfer tax declaration title 36, m.r.s.a. sections 4641-4641n please type or print clearly

Recording Requirements Deeds must be accompanied by a declaration of value form (transfer tax form) or transfer of real estate and interest therein.

Easily calculate the Maine title insurance rate & ME transfer tax. a withholding tax that is payable upon the sale of real estate by non-residents of Maine.

SUMMARY OF REAL ESTATE TRANSFER TAXES BY STATE Real estate transfer taxes are taxes imposed on the transfer of title of real Transfer tax chart,6th rev 8-15-05

Title 36 §4641-C Exemptions Maine Legislature

Estate and Gift Taxes Internal Revenue Service

The Official Maine Statewide MLS Website: Search Maine Real Estate Listings, Open Houses, Members and more . . .

MAINE REVENUE SERVICES SUPPLEMENT TO THE REAL ESTATE TRANSFER TAX FORM This form is to be used in conjunction with the Real Estate Transfer Tax (“RETT”) form and

Maine Revenue Services provides information and services related to Maine state taxes. Forms, Tax Division → Real Estate Real Estate Withholding money to

… related to Maine property taxes and exemptions, forms, Tax → Transfer Tax → County Registries of Deeds. Tax. Individual Income Tax. Real Estate

Maine Revised Statutes tax year, unless the individual, estate or trust has transfer of Maine real

Donor’s Tax; Estate Tax; Real Property Tax; Transfer Tax; Home / Real Estate Taxes / Estate Tax / Death, Real Estate, and Estate Tax. BIR Form No. 1801

What are the Canadian inheritance tax rates for property and estate? Learn more from TurboTax Forms & schedules; Canada Inheritance Tax Laws & Information.

BOOK/PAGE—REGISTRY USE ONLY. MAINE REVENUE SERVICES REAL ESTATE TRANSFER TAX . DECLARATION. 36 M.R.S. §§ 4641-4641N. 2. Municipality/Township. 1. County

HOW TO SUBMIT A PAYMENT. If tax is due at the time of transfer, please make checks payable to the Vermont Department of Taxes and complete Form PTT-173, Property

MAINE REVENUE SERVICES AND DEPARTMENT OF LABOR Territory of Maine, Real Estate Transfer Tax, see the instructions to Form 941ME or Form ME UC-1.

Home > Forms > Supplemental > Maine > Real Estate Transfer Tax. Real Estate Transfer Tax. The Transfer Tax Form (Declaration of Value) must be filed at the County Register of Deeds at the same time as the recording of the accompanying deed. A transfer tax will be collected by the Registry based on the amount of value.

Frequently Asked Questions on Estate Taxes the estate’s representative must file an estate tax return (Form 706) Frequently Asked Questions on New Tax Rules

Real Estate Transfer Tax Form (RETT) – Wilmette

Property Transfer Tax Department of Taxes

Here are common property transfer scenarios and their tax Gifts of real estate to your child are not tax as the donor, must file a gift tax return (Form

MAINE REVENUE SERVICES AND DEPARTMENT OF LABOR Territory of Maine, Real Estate Transfer Tax, see the instructions to Form 941ME or Form ME UC-1.

ISSUES: Whether the real estate Conveyance tax applies to a partner’s transfer of its interest in a partnership that owns Connecticut real estate, where the

Taxpayers are able to access a list of various questions pertaining to real estate transfer tax administered by the New Hampshire Department of Revenue Administration.

Real Estate – The real estate transfer tax is imposed on each deed by which any real property in this State is transferred. The register of deeds will compute the tax based on the value of the property as set forth in the declaration of value.

In Maine, when real property, or even a partial interest in property, is transferred, there is usually transfer tax due, which is paid to the Registry of Deeds at the time the deed is recorded. Some types of transfers are exempt from the tax, as listed in 36 MRS §4641-C.

21 Comments

Aidan

Instructions to the Real Estate Transfer Tax Form: Real Estate Transfer Tax Declaration. The Washington County Registry of Deeds records various public documents

Freeport Maine Assessor

Maine Real Estate Transfer Tax Deeds.com

Maine Real Estate MaineListings.com

Avery

Driver License Forms. Property Tax Forms. All content © 2017 Constitutional Tax Collector, Serving Palm Beach County Real Estate Property Tax;

Maine Real Estate Transfer Tax Form Accfdb on Revenue

Paige

The Real Estate Market . which results in a pre-payment of tax. In other cases, the transfer of a cottage is part of Welcome to The Globe and Mail’s comment

Maine Real Estate Transfer Tax Form Accfdb on Revenue

Real Estate Transfer Tax (RETT) NH Department of Revenue

Diego

Real estate transfer taxes are taxes imposed by states, counties and municipalities on the transfer of the title of real property.

Estate and Gift Taxes Internal Revenue Service

Maine title insurance rate & ME transfer tax cost calculator

MAINE REVENUE SERVICES AND DEPARTMENT OF LABOR

Alyssa

The Maine Real Estate Transfer Tax is one of the costs for Maine buyers and sellers that is often forgotten in initial estimate of closing costs. The transfer tax is assessed on deed transfers in Maine, and split evenly between the buyer and seller upon closing. …

Title 36 §5250-A Withholding on sales of real estate

Is there realty transfer tax due when an individual

Maine title insurance rate & ME transfer tax cost calculator

Thomas

Instructions to the Real Estate Transfer Tax Form: Real Estate Transfer Tax Declaration. The Washington County Registry of Deeds records various public documents

Maine Real Estate Resources watervillelaw.com

Property Transfer Among Family Members Block Advisors

Avoiding Probate in Maine Nolo.com

Angelina

Avoiding Probate in Maine. In Maine, this form of joint ownership Transfer-on-death deeds for real estate. Maine does not allow real estate to be transferred

Real Estate Transfer Tax (RETT) NH Department of Revenue

Title 36 §4641-C Exemptions Maine Legislature

Real Changes to the Real Estate Transfer Tax Signed Into

Kaylee

Maine Revised Statutes tax year, unless the individual, estate or trust has transfer of Maine real

Title 36 §4641-D Declaration of value Maine Legislature

Maine Real Estate Transfer Tax Deeds.com

Is there realty transfer tax due when an individual

Alexa

The Official Maine Statewide MLS Website: Search Maine Real Estate Listings, Open Houses, Members and more . . .

Maine Real Estate Transfer Tax Deeds.com

Real Estate Transfer Tax – Individuals Title Companies

Is there realty transfer tax due when an individual

Diego

The Maine Association of REALTORS mission is to support the Maine real estate industry and the business efforts of Maine REALTORS.

MAINE REVENUE SERVICES AND DEPARTMENT OF LABOR

Real property transfer forms Department of Taxation and

Estate and Gift Taxes Internal Revenue Service

Rebecca

Your estate will owe Maine estate tax only if it’s worth more than .2 million.

Tax Assessment City of Caribou Maine

Real property transfer forms Department of Taxation and

Commissioner’s Certificate Department of Taxes

Austin

Your estate will owe Maine estate tax only if it’s worth more than .2 million.

Commissioner’s Certificate Department of Taxes

Kayla

In Maine, when real property, or even a partial interest in property, is transferred, there is usually transfer tax due, which is paid to the Registry of Deeds at the time the deed is recorded. Some types of transfers are exempt from the tax, as listed in 36 MRS §4641-C.

Title 36 §4641-D Declaration of value Maine Legislature

Julian

BOOK/PAGE—REGISTRY USE ONLY. MAINE REVENUE SERVICES REAL ESTATE TRANSFER TAX . DECLARATION. 36 M.R.S. §§ 4641-4641N. 2. Municipality/Township. 1. County

Online Forms Constitutional Tax Collector Serving Palm

Maine Real Estate Deed Forms Fill In The Blank – Deeds.com

Lillian

Home > Forms > Supplemental > Maine > Real Estate Transfer Tax. Real Estate Transfer Tax. The Transfer Tax Form (Declaration of Value) must be filed at the County Register of Deeds at the same time as the recording of the accompanying deed. A transfer tax will be collected by the Registry based on the amount of value.

Closing Costs and Fees Maine Home Connection

Maine Real Estate Transfer Tax Form Accfdb on Revenue

Megan

Document Number (fillable PDF) Document Number (print PDF) Document Description; CD-57-P (fillable) CD-57-P (print) Real Estate Transfer Tax Declaration of

County Registries of Deeds Property Tax MRS Maine.gov

Closing Costs and Fees Maine Home Connection

James

Instructions to the Real Estate Transfer Tax Form: Real Estate Transfer Tax Declaration. The Washington County Registry of Deeds records various public documents

maine revenue services supplement to the real estate

Jessica

Real Estate Transfer Tax Form (RETT) Real_Estate_Transfer_Tax_Form_6-18-20151.pdf: File Size: 2.0 MiB: Date: March 14, 2016: Downloads: 4385: Platforms: Windows 8

How Do I Transfer a Title of Real Estate? Home Guides

Estate and Gift Taxes Internal Revenue Service

Amia

withhold state income tax when real property located in Maine is acquired from a nonresident of Maine. The buyer must withhold and remit to the state tax assessor 2.5% of the consideration received by the transferor (seller) on the transfer. A completed Form REW …

Maine title insurance rate & ME transfer tax cost calculator

Jasmine

The need for a Certificate Releasing Massachusetts Estate Tax Lien (Form A release of Massachusetts estate tax lien is required against all Massachusetts real

Maine Estate Taxes 2018 Maine Inheritance Taxes Guide

Tax Assessment City of Caribou Maine

Maine Real Estate Transfer Tax Form Accfdb on Revenue

Cameron

In Maine, when real property, or even a partial interest in property, is transferred, there is usually transfer tax due, which is paid to the Registry of Deeds at the time the deed is recorded. Some types of transfers are exempt from the tax, as listed in 36 MRS §4641-C.

How Do I Transfer a Title of Real Estate? Home Guides