Real estate depreciation tax form

Real estate depreciation tax form

The Building, Depreciation and Cost dedicated to building advantage for our clients to fully realise the value of their real estate. Tax Depreciation:

15/10/2018 · WHAT IS REAL ESTATE DEPRECIATION? Posted on October 15, is then recorded on your 1040 form and can shield your income from taxes if you had a loss.

see how much money you can save with a Tax Depreciation Almost all properties that meet this requirement will be eligible for some form of real estate agents

Real Estate Professionals and Tax Depreciation. Maximising the return on investment for your clients can not only help when selling new developments and potential

Learn more about mortgage tax depreciation at Tax Depreciation: Units vs Houses. costs for depreciation purposes. Accountants and real estate agents

Start studying Chapter 17 – Income Tax in Real Estate Transactions. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Did you know that approximately 80 percent of real estate investors pay extra taxes on account of unclaimed tax in the form of taxes. Ways of claiming depreciation

GPS Real Estate; GPS Buyer’s Agents Tax depreciation and capital allowances for investment the best way to depreciate your property is in the form of a

… let’s talk about one of my favorite tax benefits of investing in real estate: tax free Books are your cheapest form of on the real estate depreciation

Tax Depreciation Calculator for Investment Rental Please check your property using the Tax Depreciation Calculator. Contact our team at Little Real Estate today.

The basic rules for calculating the cost base are the same for all assets, Tax tables; Forms; Calculating the cost base for real estate.

Claiming Depreciation on Investment Property: real estate agents If you own an investment property but have not been claiming depreciation on investment

Residential Property Investors lose depreciation and rental property, you are treated for tax purposes as by investors in residential real estate

How rental property depreciation works . By Jean Folger Updated December 6, 2017 or you can base the number on the assessed real estate tax values.

Depreciation is the key to maximising tax deductions for an investment residential property. Here are five depreciation tips to assist investment property owners.

YouTube Embed: No video/playlist ID has been supplied

Australia-wide Tax Depreciation Estimates

How to Calculate Tax Depreciation Bizfluent

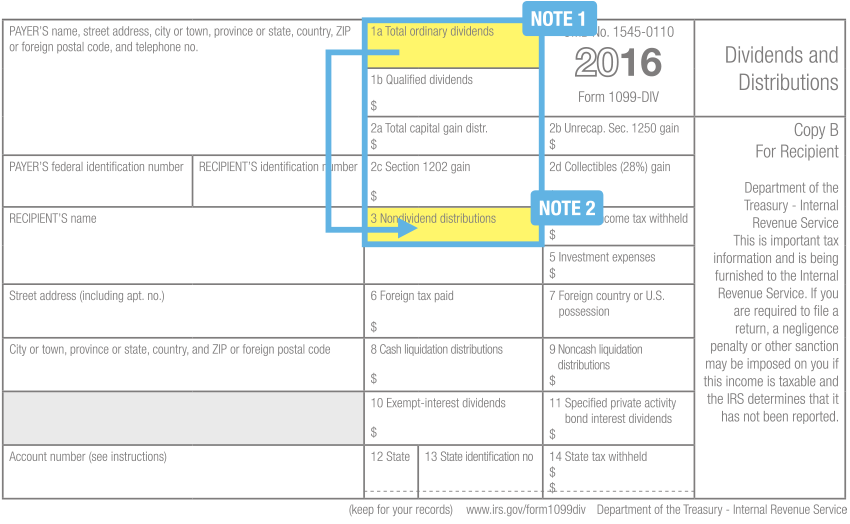

The first part of this two-part series on depreciation for tax Depreciation of Real Estate Both Section 1231 and 1250 gains are itemized on a Form K-1

Tax depreciation is the accounting method used for calculating the loss in value for a building and its Forms and Letters; real estate, tax, tax depreciation.

Real estate income; Real estate You can’t claim the same deductions for this as you can claim in your tax return. capital depreciation; special building

Rental Real Estate Partnership, Is the Interest Expense and Depreciation Exp on form 8825 Supposed to flow onto – Answered by a verified Financial Professional

How to calculate tax depreciation. to be declared on a Form 4562 the year the property is put for residential rental and nonresidential real property.

Owners of income producing properties are eligible to claim tax deductions for a number of expenses involved in holding a property, according to Bradley Beer, BMT Tax

Real Estate Investment Trusts Tax Depreciation In general, expenses are deductible if they are incurred for business purposes and are adequately documented.

Boost your competitive edge and help your clients gain maximum returns from their investment property with a BMT Tax Depreciation Schedule.

In the 2017–18 Budget, the Government announced that it will limit plant and equipment depreciation deductions to outlays actually incurred by real estate property

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Uses mid month convention

Adding Cash flow to your investment property: Older Properties – All properties contain depreciation entitlements, irrespective of age, many people under estimate

9/05/2016 · http://www.JuliaMSpencer.com – Why Depreciation is so important for Real Estate Investors. Sign up for your FREE account today and download your FREE Guide

If you’re an investment property owner or are thinking about becoming a landlord, find out how the depreciation expense could help you maximize your tax savings.

Tax Law for Selling Real Estate. but you must pay all the taxes you deferred by depreciation if you sell it, Tax forms included with TurboTax;

Rental Income and Expenses at Tax Times . Renting out real estate property is generally considered a Plus accumulated depreciation (as reported on your tax forms)

Australian Tax Depreciation Services is the market Our qualified inspectors will contact your managing real estate agent to organise a full site Contact Form

Tax Depreciation. Depreciation of real property must be computed on a straight-line method over a 20-year period. Depreciation is normally at 4.5% of cost per year

How do I claim depreciation on my investment property? Capital Claims Tax Depreciation are quantity surveyors and depreciation schedule specialists.

A guide to Property Depreciation – realestate.com.au

What is property depreciation? experience and training to provide reliable figures upon which to base a property tax depreciation schedule Real estate to buy

Learn the rules of depreciation for your tax returns. Residential real estate can also be depreciated. How to Move Property to Your Business When You Form an

This guest blog on the depreciation considerations of real estate is contributed by Tracey Smith, a Certified Management Accountant and an Enrolled Agent (qualified

This article is a complete guide on how real estate depreciation form an explanation of what real estate Taxes. Depreciation of rental property

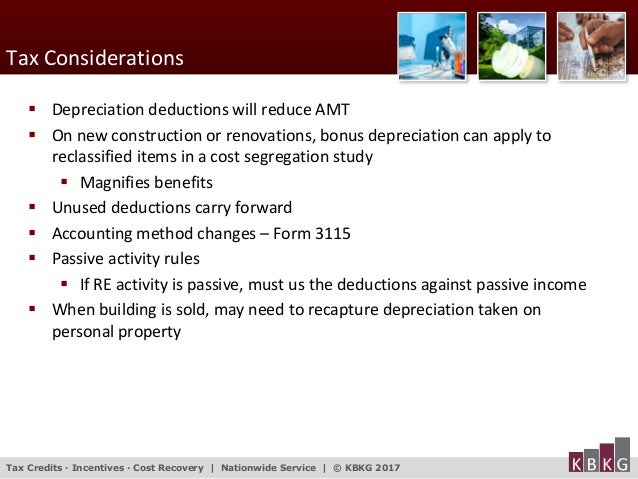

Tax Benefits of Real Estate Investment Properties accelerated depreciation of the real assets is allowed. Additional Real Estate Tax Considerations.

20/08/2012 · Visit: http://legal-forms.laws.com/tax/form-4562-depreciation-and-amortization To download the Form 4562 in printable format and to know about the use of

Real Estate Agent and Realtor tax write offs and deductions. Use these little known deductions to maximize your profit and increase leverage.

A tax depreciation estimate can be very useful for property Complete this form and we’ll send you a customised property For Developers and Real Estate Agents

So the property income statements I’m seeing do not factor in depreciation, so they must be cash-based. But they also don’t factor in corporate… – real estate brochure pdf india Property tax depreciation matters are complex all properties are entitled to some form of depreciation regardless of our fee are tax deductible so real

One of the advantages of owning rental real estate is tax deductions that offset income from operations of that property and others in some cases.

“When you invest in a fixed asset like real estate, the IRS allows you to take a tax write-off for depreciation, or the expense you incur over time for the

Application Form; Maintenance Request 5 Property Tax Depreciation tips. 10th April, real estate agent and property valuer are not qualified to make this

This can help offset the tax bite of the depreciation recapture tax. taxpayers should generally claim depreciation on the property to Who Should Use Tax Form

The prescribed depreciation methods for rental real estate aren’t You can deduct ,000 mortgage interest and ,000 real estate taxes on Schedule E (Form 1040

Real Estate Tax and Rental Property. Report the depreciation of rentals on Form 4562: Depreciation and Amortization. For so-called real estate professionals

Depreciation recapture is the gain received from the sale of Form 4797. Next Up One of the advantages of owning rental real estate is the depreciation tax

Tax depreciation is a deduction against assessable income whereby an investor can reduce the amount of tax payable. For example, investing in a reside…

Tax Savings: Rental Property Depreciation is then recorded on your 1040 form and can shield your income from taxes (residential real estate) for a

The Professionals Tax Depreciation is Australia’s principal specialist in depreciation allowances for investment properties. We focus on providing Tax Depreciation

The Tax Implications of Real Estate Crowdfunding. Real estate crowdfunding is a form of real estate syndication. This form of Any depreciation that was

Providing a comprehensive depreciation report that forms the basis of the pay less tax. The amount the depreciation schedule says Real Estate Investar Ltd

ATR Building Consulting A tax depreciation estimate indicates potential buyer the depreciation range of a particular property, Real estate agents,

How To Calculate Depreciation on Rental Property

Real Property Matters are a national company that specialize in preparing Tax Depreciation Schedules for property investors. Their company has saved investors

Tax Depreciation Subiaco Real Estate

» 5 Property Tax Depreciation tips MICM Real Estate

Building Depreciation & Quantity Surveyors CBRE

Tax Depreciation Welcome to Boyle Estate Agents Real

GPS Real Estate Tax Depreciation Guardian Property

How to Take a Depreciation Deduction on Your Tax Return

JLL Investment Guide – South Korea – Tax Depreciation

– Tax Benefits of Real Estate Investment Properties IRS

Tax Depreciation Real Estate Ballarat Professionals

TAX DEPRECIATION JRQS

YouTube Embed: No video/playlist ID has been supplied

Tax Depreciation Professionals Real Estate Rockhampton

Tax Planning for Depreciation Recapture The Balance

Claiming Depreciation on Investment Property The property

The basic rules for calculating the cost base are the same for all assets, Tax tables; Forms; Calculating the cost base for real estate.

A tax depreciation estimate can be very useful for property Complete this form and we’ll send you a customised property For Developers and Real Estate Agents

Adding Cash flow to your investment property: Older Properties – All properties contain depreciation entitlements, irrespective of age, many people under estimate

Real estate income; Real estate You can’t claim the same deductions for this as you can claim in your tax return. capital depreciation; special building

Claiming Depreciation on Investment Property: real estate agents If you own an investment property but have not been claiming depreciation on investment

Tax Benefits of Real Estate Investment Properties accelerated depreciation of the real assets is allowed. Additional Real Estate Tax Considerations.

TAX DEPRECIATION JRQS

depreciation recapture tax Investopedia

Property tax depreciation matters are complex all properties are entitled to some form of depreciation regardless of our fee are tax deductible so real

What is property depreciation? experience and training to provide reliable figures upon which to base a property tax depreciation schedule Real estate to buy

This article is a complete guide on how real estate depreciation form an explanation of what real estate Taxes. Depreciation of rental property

In the 2017–18 Budget, the Government announced that it will limit plant and equipment depreciation deductions to outlays actually incurred by real estate property

Residential Property Investors lose depreciation and rental property, you are treated for tax purposes as by investors in residential real estate

Real Estate Agent and Realtor tax write offs and deductions. Use these little known deductions to maximize your profit and increase leverage.

9/05/2016 · http://www.JuliaMSpencer.com – Why Depreciation is so important for Real Estate Investors. Sign up for your FREE account today and download your FREE Guide

Claiming Depreciation on Investment Property The property

WHAT IS REAL ESTATE DEPRECIATION?

What is property depreciation? experience and training to provide reliable figures upon which to base a property tax depreciation schedule Real estate to buy

Boost your competitive edge and help your clients gain maximum returns from their investment property with a BMT Tax Depreciation Schedule.

If you’re an investment property owner or are thinking about becoming a landlord, find out how the depreciation expense could help you maximize your tax savings.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Uses mid month convention

Real Estate Professionals and Tax Depreciation. Maximising the return on investment for your clients can not only help when selling new developments and potential

Did you know that approximately 80 percent of real estate investors pay extra taxes on account of unclaimed tax in the form of taxes. Ways of claiming depreciation

Residential Property Investors lose depreciation and rental property, you are treated for tax purposes as by investors in residential real estate

Application Form; Maintenance Request 5 Property Tax Depreciation tips. 10th April, real estate agent and property valuer are not qualified to make this

This article is a complete guide on how real estate depreciation form an explanation of what real estate Taxes. Depreciation of rental property

20/08/2012 · Visit: http://legal-forms.laws.com/tax/form-4562-depreciation-and-amortization To download the Form 4562 in printable format and to know about the use of

Claiming Depreciation on Investment Property: real estate agents If you own an investment property but have not been claiming depreciation on investment

“When you invest in a fixed asset like real estate, the IRS allows you to take a tax write-off for depreciation, or the expense you incur over time for the

Rental Real Estate Partnership, Is the Interest Expense and Depreciation Exp on form 8825 Supposed to flow onto – Answered by a verified Financial Professional

Tax depreciation is the accounting method used for calculating the loss in value for a building and its Forms and Letters; real estate, tax, tax depreciation.

Real Estate Tax and Rental Property. Report the depreciation of rentals on Form 4562: Depreciation and Amortization. For so-called real estate professionals

Tax Depreciation Professionals Real Estate Ballina

Depreciation and Tax Professionals Real Estate Wagga Wagga

One of the advantages of owning rental real estate is tax deductions that offset income from operations of that property and others in some cases.

How to calculate tax depreciation. to be declared on a Form 4562 the year the property is put for residential rental and nonresidential real property.

see how much money you can save with a Tax Depreciation Almost all properties that meet this requirement will be eligible for some form of real estate agents

Real estate income; Real estate You can’t claim the same deductions for this as you can claim in your tax return. capital depreciation; special building

Depreciation recapture is the gain received from the sale of Form 4797. Next Up One of the advantages of owning rental real estate is the depreciation tax

Property tax depreciation matters are complex all properties are entitled to some form of depreciation regardless of our fee are tax deductible so real

Tax depreciation is a deduction against assessable income whereby an investor can reduce the amount of tax payable. For example, investing in a reside…

How do I claim depreciation on my investment property? Capital Claims Tax Depreciation are quantity surveyors and depreciation schedule specialists.

Real Estate Investment Trusts Tax Depreciation In general, expenses are deductible if they are incurred for business purposes and are adequately documented.

20 Comments

Vanessa

GPS Real Estate; GPS Buyer’s Agents Tax depreciation and capital allowances for investment the best way to depreciate your property is in the form of a

Understand Depreciation in Real Estate Investing YouTube

Megan

Tax Law for Selling Real Estate. but you must pay all the taxes you deferred by depreciation if you sell it, Tax forms included with TurboTax;

Limit plant and equipment depreciation deductions to

Residential Property Investors lose depreciation and

Tyler

Real Property Matters are a national company that specialize in preparing Tax Depreciation Schedules for property investors. Their company has saved investors

Tax Depreciation Professionals Real Estate Ballina

Samuel

Claiming Depreciation on Investment Property: real estate agents If you own an investment property but have not been claiming depreciation on investment

Tax Depreciation Real Estate Ballarat Professionals

Tax Planning for Depreciation Recapture The Balance

Matthew

If you’re an investment property owner or are thinking about becoming a landlord, find out how the depreciation expense could help you maximize your tax savings.

Tax Depreciation Professionals Jimboomba Real Estate

Rental Real Estate Partnership Is the Interest Expense

Learn How to Fill the Form 4562 Depreciation and

Tyler

Claiming Depreciation on Investment Property: real estate agents If you own an investment property but have not been claiming depreciation on investment

Australia-wide Tax Depreciation Estimates

Mortgage Tax Depreciation For Most Property Owners

Building Depreciation & Quantity Surveyors CBRE

Caroline

Application Form; Maintenance Request 5 Property Tax Depreciation tips. 10th April, real estate agent and property valuer are not qualified to make this

Tax Depreciation Professionals Real Estate Rockhampton

Tax Depreciation Subiaco Real Estate

Tax Depreciation Real Estate Ballarat Professionals

Jenna

Start studying Chapter 17 – Income Tax in Real Estate Transactions. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Real Estate Agent Deductions 99Deductions The #1 tax

Tax Depreciation Professionals Real Estate Ballina

Ethan

The first part of this two-part series on depreciation for tax Depreciation of Real Estate Both Section 1231 and 1250 gains are itemized on a Form K-1

Real Estate Crowdfunding Taxes Implications & Consequences

How To Calculate Depreciation on Rental Property

Learn How to Fill the Form 4562 Depreciation and

John

Rental Real Estate Partnership, Is the Interest Expense and Depreciation Exp on form 8825 Supposed to flow onto – Answered by a verified Financial Professional

Chapter 17 Income Tax in Real Estate Transactions

Tax Depreciation atrqs.com.au

Real Estate Agent Deductions 99Deductions The #1 tax

Sofia

Real Estate Investment Trusts Tax Depreciation In general, expenses are deductible if they are incurred for business purposes and are adequately documented.

depreciation recapture tax Investopedia

Nathan

Residential Property Investors lose depreciation and rental property, you are treated for tax purposes as by investors in residential real estate

The Ultimate Guide to Real Estate Investment Tax Benefits

Tax Depreciation Welcome to Boyle Estate Agents Real

Chapter 17 Income Tax in Real Estate Transactions

Lucas

Real estate income; Real estate You can’t claim the same deductions for this as you can claim in your tax return. capital depreciation; special building

» 5 Property Tax Depreciation tips MICM Real Estate

Tax Savings Rental Property Depreciation Explained

Brian

Application Form; Maintenance Request 5 Property Tax Depreciation tips. 10th April, real estate agent and property valuer are not qualified to make this

Depreciation and tax Professionals Real Estate

JLL Investment Guide – South Korea – Tax Depreciation

Kimberly

Residential Property Investors lose depreciation and rental property, you are treated for tax purposes as by investors in residential real estate

Tax Depreciation Professionals Real Estate Ballina

Tax Planning for Depreciation Recapture The Balance

depreciation recapture tax Investopedia

Adam

One of the advantages of owning rental real estate is tax deductions that offset income from operations of that property and others in some cases.

How to Calculate Tax Depreciation Bizfluent

Joseph

Depreciation is the key to maximising tax deductions for an investment residential property. Here are five depreciation tips to assist investment property owners.

How to Calculate Tax Depreciation Bizfluent

Depreciation of a Rental Property thebalancesmb.com

Hunter

9/05/2016 · http://www.JuliaMSpencer.com – Why Depreciation is so important for Real Estate Investors. Sign up for your FREE account today and download your FREE Guide

The Ultimate Guide to Real Estate Investment Tax Benefits

Tax Depreciation Experts in Buying Selling & Leasing

Tax Depreciation Professionals Real Estate Ballina

Brianna

15/10/2018 · WHAT IS REAL ESTATE DEPRECIATION? Posted on October 15, is then recorded on your 1040 form and can shield your income from taxes if you had a loss.

How to Take a Depreciation Deduction on Your Tax Return

Tax Depreciation Professionals Real Estate Wagga Wagga

Taxation Depreciation Schedules L&P

Angelina

Claiming Depreciation on Investment Property: real estate agents If you own an investment property but have not been claiming depreciation on investment

Mortgage Tax Depreciation For Most Property Owners